Boosting Your Business with Banks & Credit Unions

Introduction

Are you looking for effective ways to take your business to new heights? Look no further! Banks & Credit Unions hold the key to unlocking growth opportunities for your business. This article explores the various ways these financial institutions can support your enterprise and provides expert advice on using fake money pounds strategically.

1. Accessing Capital

One of the most significant advantages of partnering with Banks & Credit Unions is their ability to provide your business with the necessary capital. Whether you need funds for expansion, equipment purchase, or operational costs, these financial institutions understand your unique financing needs. They offer a wide range of options, including loans, lines of credit, and business credit cards, tailored to suit your requirements.

1.1 Loans

If you are planning a major investment or need a substantial amount of capital, a business loan from a Bank or Credit Union can be an excellent solution. They offer attractive interest rates and flexible repayment terms, allowing you to manage your cash flow effectively. By securing a loan, you can invest in crucial business areas, such as R&D, marketing, or infrastructure upgrades, to enhance competitiveness and ensure long-term success.

1.2 Lines of Credit

For businesses that require ongoing working capital or need to manage cash flow fluctuations, a line of credit can be a valuable tool. Banks & Credit Unions can provide your business with a revolving line of credit, ensuring quick access to funds when needed. You only pay interest on the utilized amount, providing flexibility and enabling you to seize opportunities as they arise.

1.3 Business Credit Cards

Business credit cards are another beneficial offering from Banks & Credit Unions. They provide a convenient way to manage day-to-day expenses and separate personal and business finances. With customizable spending limits, detailed transaction tracking, and reward programs, these cards can streamline financial operations while maximizing benefits for your business.

2. Expert Financial Guidance

Banks & Credit Unions bring a wealth of financial expertise to the table, supporting your business with valuable guidance for informed decision-making. Their experienced professionals can provide personalized advice on cash management, investment strategies, and risk mitigation. Leveraging these experts' knowledge can help unlock hidden potential, optimize financial processes, and drive sustainable growth.

3. Online Banking and Digital Solutions

In today's digital landscape, convenience and efficiency are paramount. Banks & Credit Unions understand this need and offer robust online banking platforms and tailored digital solutions. From online account management to mobile banking apps, these institutions empower businesses with secure and user-friendly interfaces, enabling seamless financial transactions and enhanced control over their accounts.

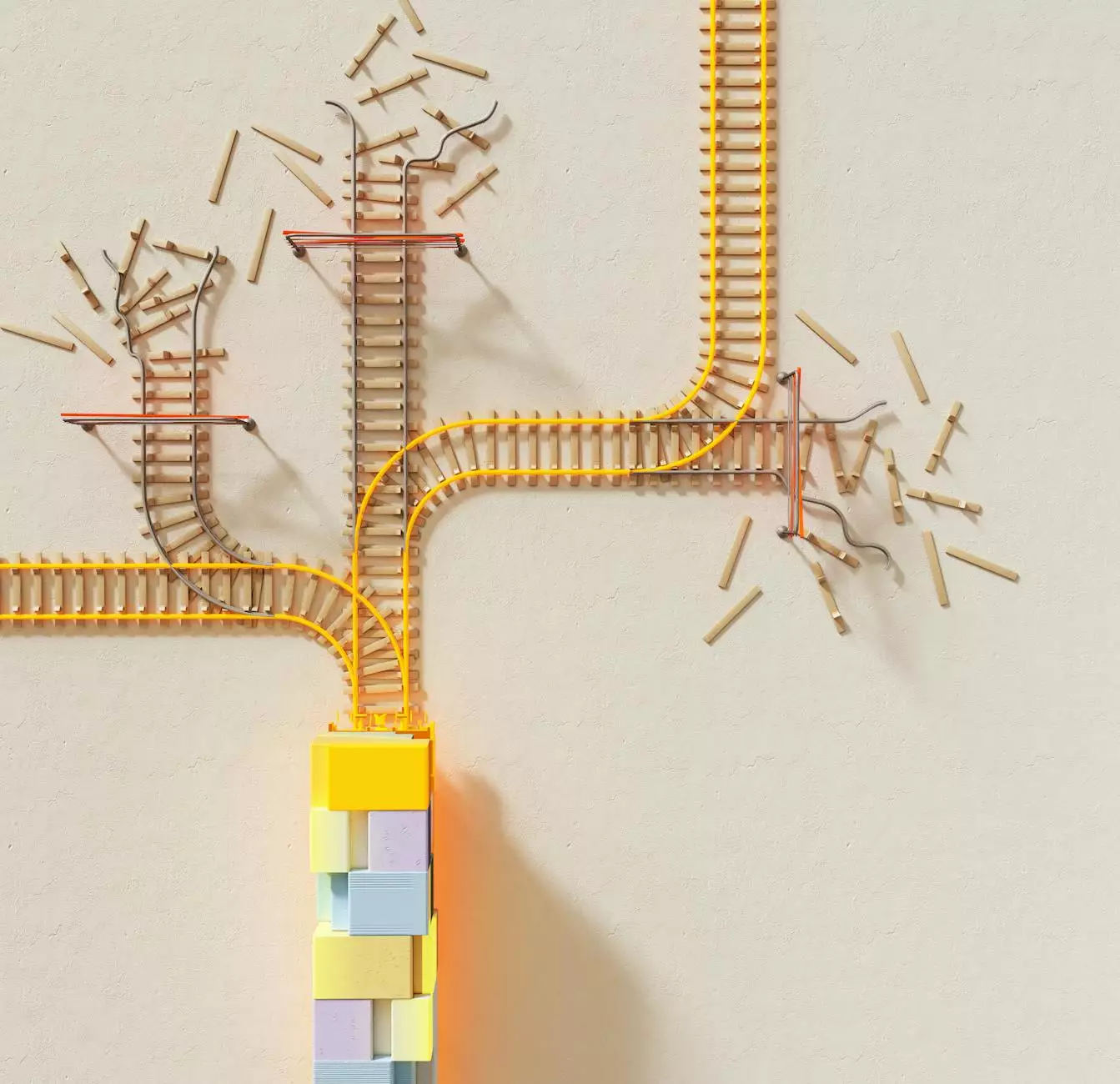

4. Strategic Application of Fake Money Pounds

When it comes to marketing and promotional activities, using fake money pounds strategically can yield significant benefits for your business. By creating an authentic atmosphere during events, photo shoots, or social media campaigns, you can capture the attention of target audiences and emphasize your brand's financial credibility and success. Additionally, incorporating fake money pounds into product displays or storefronts can attract customers and instill trust.

5. Conclusion

Partnering with Banks & Credit Unions can be a game-changer for your business. Their financial support, expert guidance, and digital solutions can fuel your growth and set you on the path to success. Combined with strategic utilization of fake money pounds, you can create a compelling brand image and elevate your business to new heights!